There's a New W-4 for 2020. Here's What You Need to Know.

- Details

- Written by Drew Guthrie

- Category: Articles

The W-4 form was redesigned to reflect the changes in the 2017 tax reform law which reduced tax rates, doubled the standard deduction, and increased the child tax credit.

Your employer may ask you to complete the new W-4 but cannot require you to do so.

You don't need to fill out a new W-4 unless you need to change your withholding. For example, you may want to adjust your withholding if you had a major life change such as marriage, the birth or adoption of a child, or bought a home.

Your employer may ask you to complete the new W-4 but cannot require you to do so. If you don't, your withholding will continue to be based on your previous form.

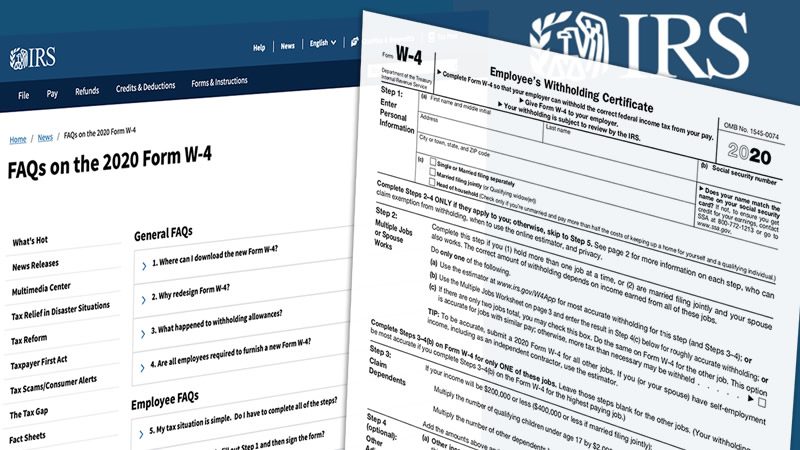

The Form Is Very Different

The goal was to reduce the form's complexity by replacing worksheets with questions. It no longer uses allowances. Instead it asks your expected filing status, family income from other jobs, number of dependents, and tax deductions to plan to claim.

If you have multiple jobs or a spouse who works, you should fill out a new W-4 at all of your jobs. The IRS recommends that you use the online Tax Withholding Estimator to get the most accurate withholding.

The Tax Withholding Estimator has been revised to reflect the new W-4. Use it to check your withholding to make sure that you are having the right amount of tax withheld from your paycheck.